Can I Consolidate Roth Iras . Gather your most recent 401 (k) and ira statements. Don't mix traditional and roth iras. Understanding which accounts can and cannot be. If you do have multiple roth ira accounts and want to merge them, the rules are similar to what they are for merging traditional ira accounts. It's ok to mix roth ira money or other assets with nondeductible ira assets because they follow the. Merging your 401(k)s and iras can minimize taxes, avoid penalties and simplify rmds. Traditional iras, 401(k)s, 403(b)s, and certain types of governmental 457(b) plans can be converted to roth iras. You’re free to split that money between ira. For roth iras and traditional iras, that’s $7,000 in 2024 ($8,000 if age 50 or older). You can usually transfer your existing assets from one roth ira to another roth ira, depending on what your roth ira is. To transfer these accounts, you. Consolidate your retirement accounts carefully. You can avoid tax penalties if these moves are made directly from.

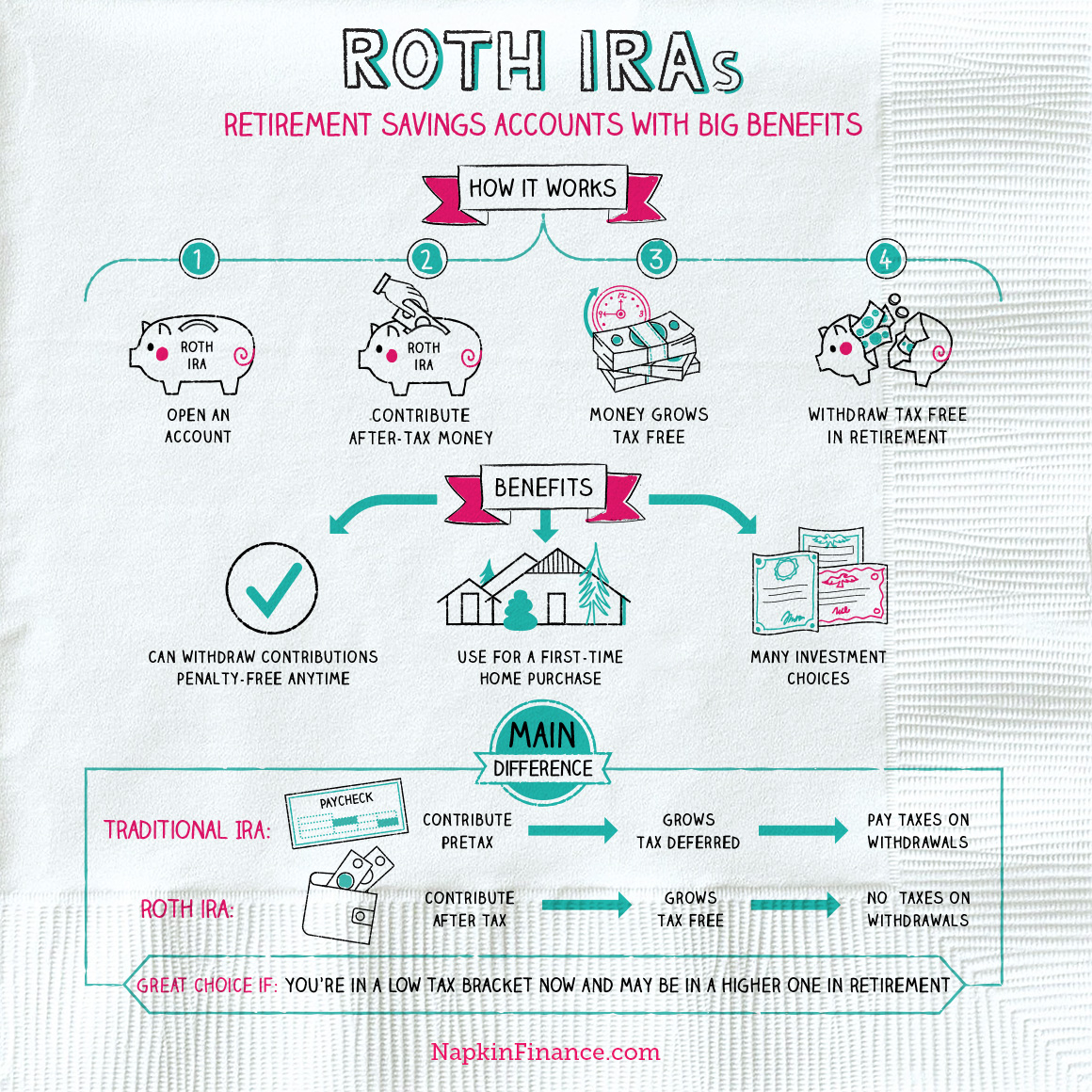

from napkinfinance.com

If you do have multiple roth ira accounts and want to merge them, the rules are similar to what they are for merging traditional ira accounts. Merging your 401(k)s and iras can minimize taxes, avoid penalties and simplify rmds. You can avoid tax penalties if these moves are made directly from. To transfer these accounts, you. Understanding which accounts can and cannot be. Consolidate your retirement accounts carefully. Don't mix traditional and roth iras. For roth iras and traditional iras, that’s $7,000 in 2024 ($8,000 if age 50 or older). You’re free to split that money between ira. Gather your most recent 401 (k) and ira statements.

Roth IRAs Napkin Finance

Can I Consolidate Roth Iras Gather your most recent 401 (k) and ira statements. For roth iras and traditional iras, that’s $7,000 in 2024 ($8,000 if age 50 or older). It's ok to mix roth ira money or other assets with nondeductible ira assets because they follow the. Traditional iras, 401(k)s, 403(b)s, and certain types of governmental 457(b) plans can be converted to roth iras. Don't mix traditional and roth iras. To transfer these accounts, you. Gather your most recent 401 (k) and ira statements. You’re free to split that money between ira. Merging your 401(k)s and iras can minimize taxes, avoid penalties and simplify rmds. You can avoid tax penalties if these moves are made directly from. If you do have multiple roth ira accounts and want to merge them, the rules are similar to what they are for merging traditional ira accounts. Consolidate your retirement accounts carefully. Understanding which accounts can and cannot be. You can usually transfer your existing assets from one roth ira to another roth ira, depending on what your roth ira is.

From inflationprotection.org

The Role of Roth IRAs in Retirement Planning Explored (Ep. 15 Can I Consolidate Roth Iras You can usually transfer your existing assets from one roth ira to another roth ira, depending on what your roth ira is. You can avoid tax penalties if these moves are made directly from. Understanding which accounts can and cannot be. Traditional iras, 401(k)s, 403(b)s, and certain types of governmental 457(b) plans can be converted to roth iras. It's ok. Can I Consolidate Roth Iras.

From napkinfinance.com

Roth IRAs Napkin Finance Can I Consolidate Roth Iras If you do have multiple roth ira accounts and want to merge them, the rules are similar to what they are for merging traditional ira accounts. You can usually transfer your existing assets from one roth ira to another roth ira, depending on what your roth ira is. Merging your 401(k)s and iras can minimize taxes, avoid penalties and simplify. Can I Consolidate Roth Iras.

From www.slideteam.net

Combine Roth Iras In Powerpoint And Google Slides Cpb Can I Consolidate Roth Iras You’re free to split that money between ira. For roth iras and traditional iras, that’s $7,000 in 2024 ($8,000 if age 50 or older). It's ok to mix roth ira money or other assets with nondeductible ira assets because they follow the. You can avoid tax penalties if these moves are made directly from. Merging your 401(k)s and iras can. Can I Consolidate Roth Iras.

From www.johnsoncpatax.com

Roth IRAs for Your Child Johnson CPA, Bellmore, Long Island, NY Can I Consolidate Roth Iras You can usually transfer your existing assets from one roth ira to another roth ira, depending on what your roth ira is. You can avoid tax penalties if these moves are made directly from. Merging your 401(k)s and iras can minimize taxes, avoid penalties and simplify rmds. Don't mix traditional and roth iras. For roth iras and traditional iras, that’s. Can I Consolidate Roth Iras.

From www.encinitasdailynews.com

Can you contribute 6000 to both Roth and traditional IRA? Encinitas Can I Consolidate Roth Iras It's ok to mix roth ira money or other assets with nondeductible ira assets because they follow the. Consolidate your retirement accounts carefully. Gather your most recent 401 (k) and ira statements. Merging your 401(k)s and iras can minimize taxes, avoid penalties and simplify rmds. You’re free to split that money between ira. Don't mix traditional and roth iras. Traditional. Can I Consolidate Roth Iras.

From bestinterest.blog

Backdoor Roth IRAs The 6Figure Power of Simple Advice The Best Interest Can I Consolidate Roth Iras Consolidate your retirement accounts carefully. If you do have multiple roth ira accounts and want to merge them, the rules are similar to what they are for merging traditional ira accounts. Traditional iras, 401(k)s, 403(b)s, and certain types of governmental 457(b) plans can be converted to roth iras. Merging your 401(k)s and iras can minimize taxes, avoid penalties and simplify. Can I Consolidate Roth Iras.

From www.pinterest.com

Roth IRAs vs. Traditional IRAs What's the DIFFERENCE? in 2022 Can I Consolidate Roth Iras You’re free to split that money between ira. You can usually transfer your existing assets from one roth ira to another roth ira, depending on what your roth ira is. If you do have multiple roth ira accounts and want to merge them, the rules are similar to what they are for merging traditional ira accounts. Merging your 401(k)s and. Can I Consolidate Roth Iras.

From cherylnkhan.blob.core.windows.net

Combine Roth Ira Accounts Spouse at Jaqueline Vaughn blog Can I Consolidate Roth Iras You can avoid tax penalties if these moves are made directly from. Gather your most recent 401 (k) and ira statements. For roth iras and traditional iras, that’s $7,000 in 2024 ($8,000 if age 50 or older). Traditional iras, 401(k)s, 403(b)s, and certain types of governmental 457(b) plans can be converted to roth iras. If you do have multiple roth. Can I Consolidate Roth Iras.

From alishayanthiathia.pages.dev

Roth Ira Contribution Limits 2024 For Married Bidget Hilliary Can I Consolidate Roth Iras You can avoid tax penalties if these moves are made directly from. For roth iras and traditional iras, that’s $7,000 in 2024 ($8,000 if age 50 or older). You’re free to split that money between ira. Understanding which accounts can and cannot be. Consolidate your retirement accounts carefully. Traditional iras, 401(k)s, 403(b)s, and certain types of governmental 457(b) plans can. Can I Consolidate Roth Iras.

From inflationprotection.org

Everything You Need to Know about Roth IRAs Inflation Protection Can I Consolidate Roth Iras Understanding which accounts can and cannot be. Merging your 401(k)s and iras can minimize taxes, avoid penalties and simplify rmds. To transfer these accounts, you. You’re free to split that money between ira. Consolidate your retirement accounts carefully. You can avoid tax penalties if these moves are made directly from. It's ok to mix roth ira money or other assets. Can I Consolidate Roth Iras.

From paulachristine.com

Episode 13 Roth IRAs Explained Paula Christine Can I Consolidate Roth Iras Gather your most recent 401 (k) and ira statements. You’re free to split that money between ira. To transfer these accounts, you. If you do have multiple roth ira accounts and want to merge them, the rules are similar to what they are for merging traditional ira accounts. You can usually transfer your existing assets from one roth ira to. Can I Consolidate Roth Iras.

From learn.moneyguy.com

Everything You Need to Know About Roth IRAs! Can I Consolidate Roth Iras You’re free to split that money between ira. Merging your 401(k)s and iras can minimize taxes, avoid penalties and simplify rmds. You can avoid tax penalties if these moves are made directly from. It's ok to mix roth ira money or other assets with nondeductible ira assets because they follow the. To transfer these accounts, you. You can usually transfer. Can I Consolidate Roth Iras.

From www.fi3advisors.com

Traditional vs. Roth IRAs What's the Difference? — Fi3 Advisors Can I Consolidate Roth Iras Gather your most recent 401 (k) and ira statements. Consolidate your retirement accounts carefully. You can usually transfer your existing assets from one roth ira to another roth ira, depending on what your roth ira is. If you do have multiple roth ira accounts and want to merge them, the rules are similar to what they are for merging traditional. Can I Consolidate Roth Iras.

From inflationprotection.org

How to Do a Backdoor Roth IRA Contribution Inflation Protection Can I Consolidate Roth Iras It's ok to mix roth ira money or other assets with nondeductible ira assets because they follow the. Merging your 401(k)s and iras can minimize taxes, avoid penalties and simplify rmds. You can usually transfer your existing assets from one roth ira to another roth ira, depending on what your roth ira is. For roth iras and traditional iras, that’s. Can I Consolidate Roth Iras.

From www.youtube.com

Can I Consolidate 3 Inherited IRA Accounts? YouTube Can I Consolidate Roth Iras Merging your 401(k)s and iras can minimize taxes, avoid penalties and simplify rmds. If you do have multiple roth ira accounts and want to merge them, the rules are similar to what they are for merging traditional ira accounts. For roth iras and traditional iras, that’s $7,000 in 2024 ($8,000 if age 50 or older). You can avoid tax penalties. Can I Consolidate Roth Iras.

From www.sdretirementplans.com

The Advantages of Owning Traditional and Roth IRAs Can I Consolidate Roth Iras You can avoid tax penalties if these moves are made directly from. If you do have multiple roth ira accounts and want to merge them, the rules are similar to what they are for merging traditional ira accounts. Gather your most recent 401 (k) and ira statements. Understanding which accounts can and cannot be. It's ok to mix roth ira. Can I Consolidate Roth Iras.

From bullincaptivity.com

Quick Comparison of Traditional and Roth IRAs Bull in Captivity Can I Consolidate Roth Iras If you do have multiple roth ira accounts and want to merge them, the rules are similar to what they are for merging traditional ira accounts. Understanding which accounts can and cannot be. You’re free to split that money between ira. It's ok to mix roth ira money or other assets with nondeductible ira assets because they follow the. Merging. Can I Consolidate Roth Iras.

From www.strategyacademy.com

Roth IRAs, Quickly Explained Strategy Academy Can I Consolidate Roth Iras For roth iras and traditional iras, that’s $7,000 in 2024 ($8,000 if age 50 or older). Traditional iras, 401(k)s, 403(b)s, and certain types of governmental 457(b) plans can be converted to roth iras. To transfer these accounts, you. You can usually transfer your existing assets from one roth ira to another roth ira, depending on what your roth ira is.. Can I Consolidate Roth Iras.